How To Challenge Insurance Claim Denial

How To Challenge Insurance Claim Denial. Some of those reasons may include: If your insurer continues to deny your claim, be persistent:

Contact your insurer right away and ask them to clarify why the bill denied. If your claim was denied, you should give serious thought to discussing the situation with a licensed attorney. Insurance companies can deny claims for a number of reasons, including the following.

When You’re Disputing A Home Insurance Claim Denial Or Low Settlement Offer, It’s Essential To Understand The Terms Of Your Coverage And The Reasons Why The Insurer Denied Your Claim.

You can appeal your denied claim by following these seven steps. Car insurance companies typically have a process in place for you to appeal the claim denial, and you can ask your insurance agent or adjuster what steps you need to take to formally dispute the company’s decision. Unfortunately, this is not an uncommon experience, but the good news is that there are some steps you can take to challenge your medical claim denial.

A Claim Denial Can Happen For A Number Of Reasons, But If You Feel It’s Unfair, You Can Take Steps To Request A Change To Your Company’s Decision.

When you can overturn a denial there are a few reasons the insurance company might deny an insurance claim. The process will vary from claim to claim and the type of insurance under debate. Insurance companies can deny claims for a number of reasons, including the following.

While Some Of The Aforementioned Reasons May Warrant A Denial, An Experienced Attorney May Be Able To Help You Challenge The Denial If Your Insurer Denied Your Claim For An Invalid Reason.

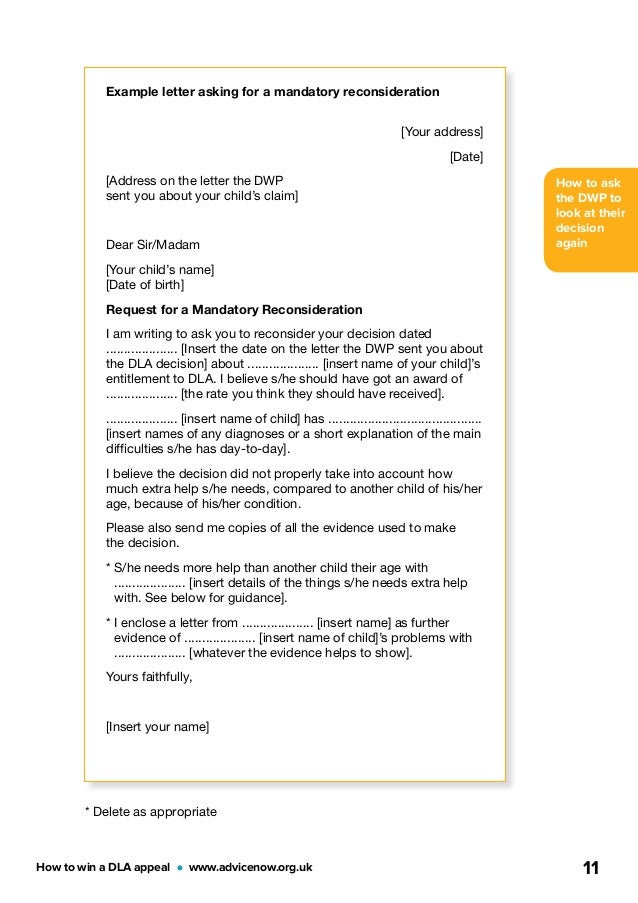

See if it indeed covers the denied benefit. Your last resort is going to your state’s department of insurance and lodging an appeal. Dear [name of insurance company] [ref:

If You Decide To Appeal An Insurance Claim Denial On Your Own, You Can Do So By Following A Few Simple Steps:.

Overall, your strategy should be to present additional evidence for your case and escalate the dispute in steps , but only up to the point where the costs of doing so are outweighed by the potential benefit. You provided false information when filing an insurance claim. • a missed deadline for filing a claim

If Your Claim Is Denied Or Your Health Insurance Coverage Canceled, You Have The Right To An Internal Appeal.

It’s important to know that the insurance policy contains the duties and obligations that each policyholder should follow, however, these tips may enable someone to challenge the insurer’s assessment before they need to involve an attorney. Keep copies of all correspondence to and from the insurance company and its adjusters or agents in writing. See also if you need to provide more information to support your claim, such as more detailed medical information.

Comments

Post a Comment