How To Calculate Worker Compensation Premium

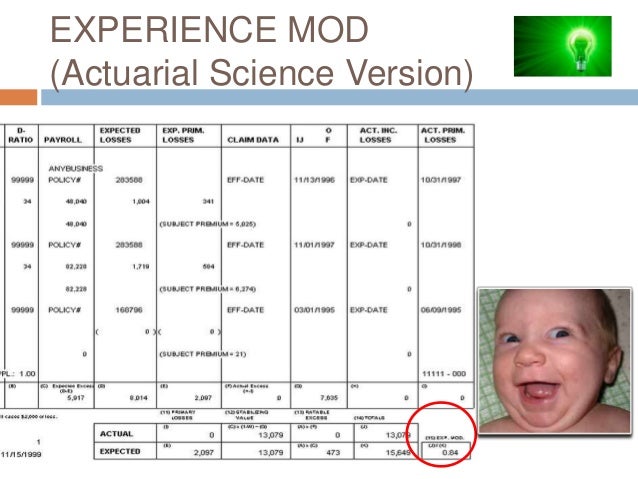

How To Calculate Worker Compensation Premium. Workers’ comp premiums are calculated based on the type of work your employees do, your payroll, and your claims history. This first calculation is done by taking our “final” or “total” net premium and dividing it by our “manual” or “subtotal” premium.

Visit our page on workers compensation payroll and remuneration for a comprehensive list of those items for your review. All premiums are calculated by taking your industry classification rate and multiplying it with how much your business pays in wages. Stock bonus or purchase plans;

Workers’ Comp Premiums Are Calculated Based On The Type Of Work Your Employees Do, Your Payroll, And Your Claims History.

Store merchandise, certificates, or credits Every business faces different types of risk, which is why we apply a premium rate based on the industry you work in. This is called average performance premium.

Visit Our Page On Workers Compensation Payroll And Remuneration For A Comprehensive List Of Those Items For Your Review.

In order to clearly explain how to handle worker compensation premiums under accrual accounting, we’ll work out an example with real numbers. Statutory insurance or pension plans; For the most part, these factors are fixed by each state, and your insurance company's discretion is strictly limited.

We’ve Outlined The Factors That Determine How Workers' Compensation Premiums Are Calculated, And Some Tips For Keeping Premium As Low As Possible.

Workers comp premium rate factors: To calculate your premium, multiply your gross insurable earnings by your premium rate and divide by 100. Premium = insurable earnings x premium rate ÷ 100

This Is Calculated By Multiplying The Employee’s Daily Wage By The Number Of Days Worked In A Full Year.

Manual premium is the result of multiplying the class code rate times the rating payroll divided by 100. In 2019 the workers’ compensation rate for florida landscapers was $8.32 per $100 of payroll. The “net” premium is always found at or near the bottom, and in this example, that number is $343,493.

Your Risk Is Expressed In Your Wcb Rate, Which Is Multiplied By Every $100 Of Your Payroll To Determine Your Premium.

All premiums are calculated by taking your industry classification rate and multiplying it with how much your business pays in wages. Your workers' compensation premiums are calculated based on your gross annual payroll. To estimate the workers’ compensation cost for an employee, divide payroll by 100, then multiply that number by your workers’ compensation insurance rate:

Comments

Post a Comment